If you are a member of the APSRTC Committee, obtaining a loan becomes easier with minimal documentation. In times of urgent financial need, APSRTC employees can conveniently access loans starting from ₹10,000, depending on their eligibility.

What is an APSRTC CCS Loan?

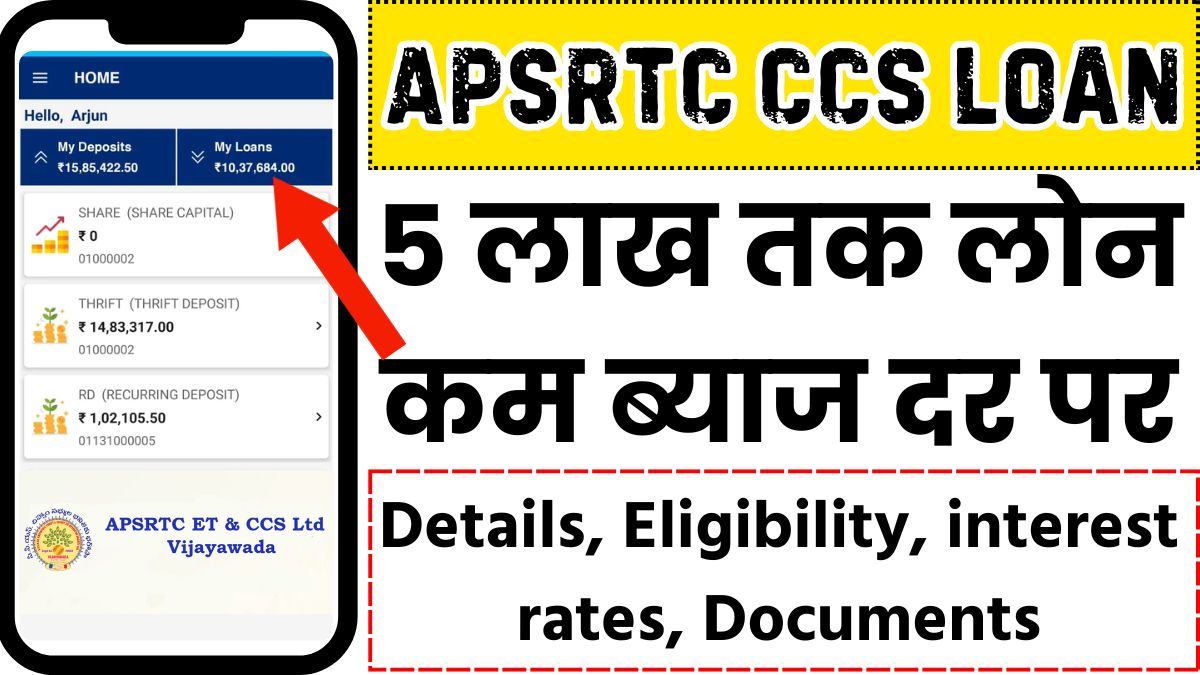

Andhra Pradesh State Road Transport Corporation (APSRTC) offers various loan options to its employees. One of the most popular schemes is the Corporate Credit Society (CCS) Loan, designed specifically for APSRTC employees to meet their financial needs, including emergency expenses.

Benefits of APSRTC CCS Loan

- Loan Amount: The loan amount depends on the employee’s monthly income and service duration.

- Types of Loans: Short-term loans, personal loans, and long-term loans.

- Interest Rates: Competitive and relatively low interest rates.

- Repayment Tenure: Usually between 1 to 5 years, extendable based on requirements.

- Repayment Method: Monthly installments are automatically deducted from the employee’s salary.

- Processing Time: Quick loan processing ensures timely financial assistance.

APSRTC CCS Loan Eligibility Criteria

To qualify for the APSRTC CCS loan, employees must meet the following criteria:

- Job Tenure: A minimum of 3 years of service with APSRTC.

- Age Limit: The applicant must be at least 21 years old.

- Salary Requirement: The applicant’s salary should be sufficient to cover loan repayments.

- Membership: Must be a member of the APSRTC Employees’ Credit Society.

- Documentation: Submission of essential documents like identity proof, salary slips, and other required certificates.

Required Documents for APSRTC CCS Loan

- Employee Certificate

- Aadhaar Card and PAN Card

- Application Form

- Salary Slip

- Bank Statement

- Recent Passport-Sized Photograph

These documents are crucial for processing the loan application smoothly.

APSRTC CCS Loan Interest & Fees

The interest rate for the APSRTC CCS Loan is 12% per annum. Additionally, a 2% processing fee applies, depending on the loan amount. The maximum loan amount is ₹5,00,000, repayable within 60 months. Payments can be made through cheque or ECS.

How to Apply for APSRTC CCS Loan Online

Follow these steps to apply for the loan:

- Get the Application Form: Collect the loan application form from the APSRTC CCS office.

- Document Submission: Submit necessary documents like identity proof, employee ID, and salary slips.

- Form Filling: Accurately fill out the application form and sign it.

- Form Submission: Submit the completed form to the concerned authority.

- Verification: The officials will verify your submitted documents.

- Approval: Upon successful verification, you will receive loan approval.

- Loan Disbursement: After approval, the loan amount will be credited to your bank account.

Conclusion

Applying for an APSRTC CCS Loan is straightforward if you meet the eligibility criteria. We hope this guide provides valuable insights into the loan process, helping you access financial support when needed.