Are you passionate about animal husbandry but worried about financing your dreams? Bank of Baroda offers a fantastic opportunity to secure loans up to ₹3 lakh without the need for collateral. Let’s explore how this can be a game-changer for you.

Understanding the Baroda Animal Husbandry and Fisheries Kisan Credit Card (BAHFKCC) Scheme

The BAHFKCC Scheme is designed to provide timely and adequate credit support to farmers and entrepreneurs involved in animal husbandry and fisheries. Whether you’re into dairy farming, poultry, or fisheries, this scheme has got you covered.

Key Features of the BAHFKCC Scheme

- Loan Amount: Avail up to ₹3 lakh without any collateral. For loans above ₹1.60 lakh, collateral such as mortgage of land or charge on agricultural land is required.

- Interest Rate: Enjoy competitive interest rates, with loans up to ₹2 lakh charged at 7% per annum, subject to Government of India interest subvention. Additionally, a prompt repayment incentive of 3% per annum is available for timely repayments.

- Repayment Period: Flexible repayment options tailored to your project’s cash flow, with a maximum repayment period of 10 years, including a moratorium period of 2 years.

- Processing and Inspection Charges: No processing or inspection charges for aggregate loans up to ₹3 lakh, making it more affordable for you to access the funds you need.

Eligibility Criteria

The scheme is open to:

- Farmers: Individual or joint borrowers involved in animal husbandry or fisheries.

- Self-Help Groups (SHGs) and Joint Liability Groups (JLGs): Engaged in related activities.

- Tenant Farmers and Sharecroppers: With necessary permissions and licenses.

How to Apply

- Prepare Necessary Documents: Ensure you have your KYC documents (Aadhaar, Voter ID, PAN Card, Driving License, etc.) and any relevant licenses for your specific animal husbandry or fisheries activities.

- Visit the Nearest Bank of Baroda Branch: Discuss your requirements with the bank officials, who will guide you through the application process.

- Submit Your Application: Complete the application form and submit it along with the required documents.

- Await Approval: The bank will process your application and, upon approval, disburse the loan amount to your account.

Benefits of Choosing Bank of Baroda’s BAHFKCC Scheme

- No Collateral Required: For loans up to ₹1.60 lakh, no collateral is needed, reducing the burden on small farmers.

- Interest Subvention and Incentives: Benefit from government interest subvention and prompt repayment incentives, lowering your effective interest rate.

- Comprehensive Coverage: The scheme covers a wide range of activities, including dairy, poultry, fisheries, and more, supporting diverse agricultural ventures.

- Flexible Repayment Options: Repayment schedules are designed to align with your income flow, ensuring ease of repayment.

Conclusion – BAHFKCC Scheme

Bank of Baroda’s Animal Husbandry Loan under the BAHFKCC Scheme is a golden opportunity for farmers and entrepreneurs to expand their ventures without the stress of hefty collateral requirements. With attractive interest rates, flexible repayment options, and government incentives, it’s the perfect time to take your animal husbandry business to new heights.

Also Read:

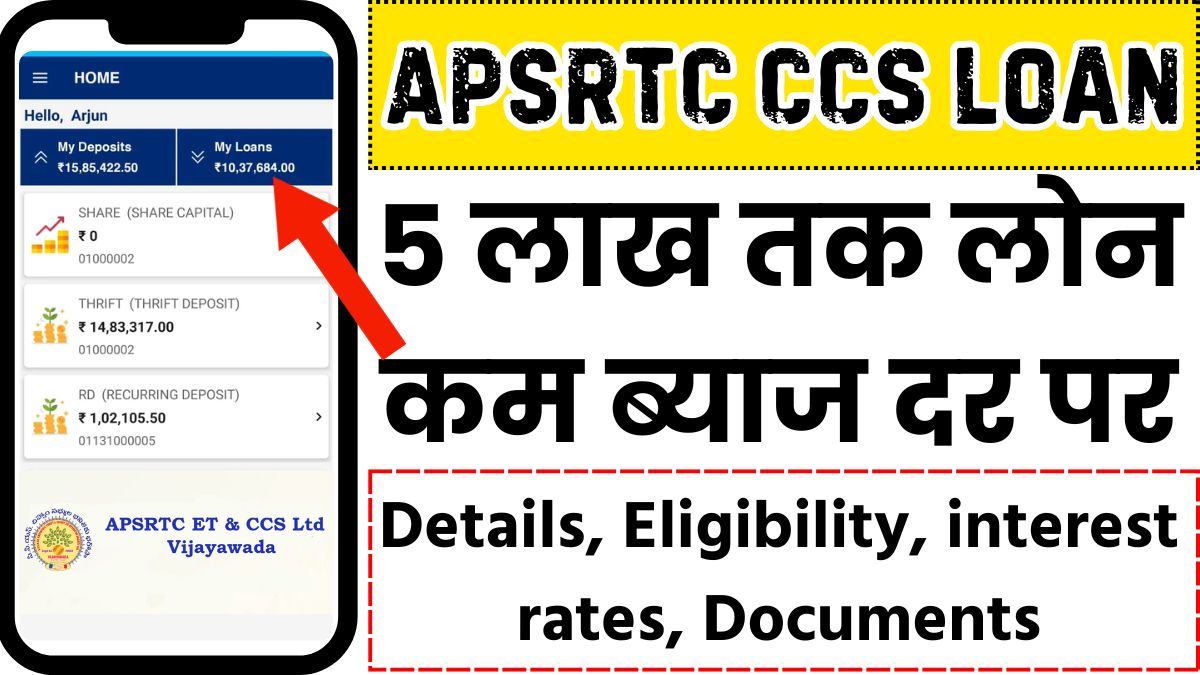

- APSRTC CCS Loan: Details, Eligibility, interest rates, Documents, Apply Online

- PaySense Personal Loan up to ₹5 Lakhs in Just 5 Minutes – Know Interest Rates, Features, Eligibility & Application Process

- Tiara Credit Card: Bank of Baroda Offers Free Vouchers & Memberships Worth ₹31,000

- Pocketly Loan App: 5000 Loan is available only on KYC (100% safe)